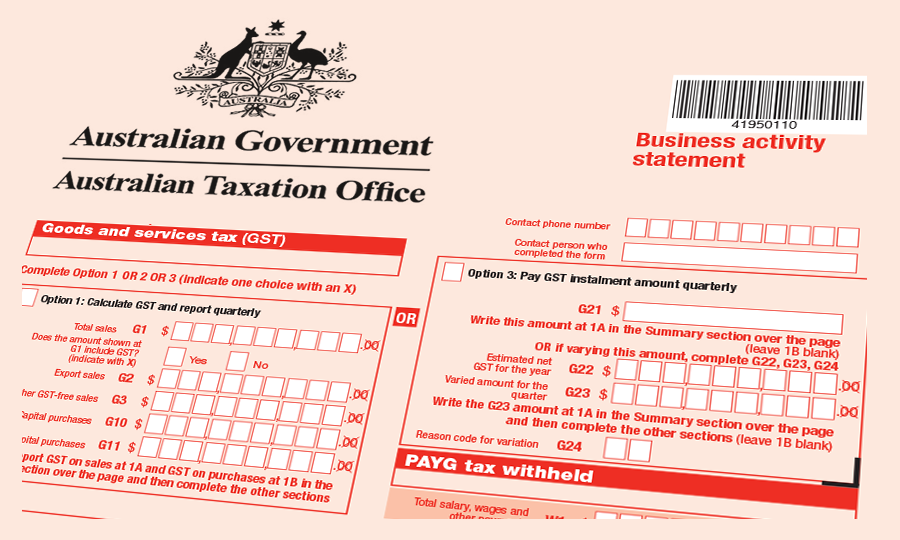

Lodging and paying business activity statements ('BASs')

The ATO is reminding taxpayers that it is important to lodge BASs and pay in full and on time to avoid penalties and interest charges.

The BAS for the first quarter of 2024/25 is generally due on 28 October, but taxpayers may receive an extra:

- four weeks if they lodge through a registered tax or BAS agent until 25 November; or

- two weeks if they lodge online.

The cost of managing tax affairs is tax deductible for taxpayers, and a registered agent's help will allow them to focus on running their business.

Need Help with your Business, Bookkeeping, Tax or SMSF requirements?

If you would like a little help, please get in touch with us for assistance. We can help with your business, bookkeeping, tax and SMSF requirements.

Please also note that many of the comments in this publication are general in nature and anyone intending to apply the information to practical circumstances should seek professional advice to independently verify their interpretation and the information’s applicability to their particular circumstances. Should you have any further questions, please get in touch with us for assistance with your SMSF, business, bookkeeping and tax requirements. All rights reserved. Brought to you by RGA Business and Tax Accountants. Liability Limited by a scheme approved under Professional Standards Legislation.